Can I Withdraw My Bitcoin

This is one of the most popular questions that we see from users of our Bitcoin ATM kiosks. Can I withdraw my Bitcoin into cash at a Bitcoin ATM? Can I sell Bitcoin at a Bitcoin ATM, or can I only buy Bitcoin? The simple answer is YES! You can withdraw cash from a Coinsource Bitcoin ATM and many other operators. It’s fast and easy.

Married couples can withdraw £45,200 without having to pay tax. And while there are some ways to cash out your Bitcoins without paying taxes, the likelihood of that lasting once government regulations tighten is doubtful. You can try doing it, but there’s a high chance of getting caught and probably not seeing any of your Bitcoin ever again. You can manually withdraw Bitcoin to your own wallet anytime. To create a withdrawal go to your Swan dashboard and scroll down to the withdrawal section. You'll receive an email to confirm your new wallet. Click to confirm your wallet and you're good to go. How can I withdraw Bitcoin from freebitco.in to my Bitcoin wallet account? Freebitco is safe secure scam free and very honest website when u open page then u can see withdraw option above the page where we can see roll a dice option. Another thing u can use auto withdraw option. Its good fast and very low transaction fees. To withdraw your funds, sign in to your Coinbase Commerce account and click on the Withdraw button next to the relevant cryptocurrency in the Balances section. A window will pop up and ask how much you would like to withdraw, and where you would like these funds to go.

In summary:

- Yes, you can convert your Bitcoin into cash at a Bitcoin ATM

- Not all Bitcoin ATMs have the ability to sell crypto

- To withdraw cash from a Bitcoin ATM, you must already have a wallet with Bitcoin in it, ready to be used.

- Coinsource offers one of the lowest rates in the U.S. to turn Bitcoin into cash using a Bitcoin ATM

How to Withdraw Cash from a Bitcoin ATM

1. Create an Account

To use a Coinsource Bitcoin ATM, you first need to have an account with us. It’s easy, free, and quick to enroll with your mobile device.

2. Find a Bitcoin ATM Near You to Withdraw Cash

Second, once you have created your Coinsource account (or other account), you will need to locate a 2-way (buy and sell capability) Coinsource Bitcoin ATM near you. Using a different operator? CoinATMRadar has a complete listing of Bitcoin ATMs with crypto selling capabilities.

3. Have Your Wallet Address Ready to Convert Your Bitcoin to Cash

Because you are withdrawing cash, you need to already own Bitcoin and have your transactions stored in a wallet. Have the wallet address where your Bitcoin is stored available and ready.

Remember, this is your private key. If you have multiple wallets and/or multiple keys, select the one you want to use in this transaction.

4. Withdraw Cash from the 2-Way Bitcoin ATM

When you are at the 2-way kiosk, log in to your account on the Bitcoin ATM, and select the “Withdraw Cash” option. If the Bitcoin ATM you are using does not have this option available on the screen, it most likely does not have crypto selling capabilities. Make sure the location you are using has the ability to sell Bitcoin. Enter the amount of cash you wish to withdraw and send Bitcoin to the wallet address QR code indicated.

Final Notes

Once the transaction is confirmed on the blockchain network, you can collect your cash. This typically happens in under 30 minutes and this wait time is outside of the operator’s control.

All Bitcoin operators charge a fee for using the Bitcoin ATM to buy or sell Bitcoin. However, Coinsource has one of the lowest fees of all the Bitcoin ATM operators in the United States. This means that you’ll take home the most cash possible from the Bitcoin you are withdrawing!

NOTE: Not all Coinsource machines support two-way operations yet, and some of our kiosks only allow you to purchase Bitcoin or send cash to someone’s wallet. Be sure to find a 2-way Coinsource kiosk if you want to convert your Bitcoin into cash. Sign up today with Coinsource to withdraw your Bitcoin to cash!

Related Posts

- Buy Bitcoin with Cash at a Coinsource Bitcoin ATM

Check out our quick video where MICA (our Mobile Interactive Coinsource Assistant) explains how to…

- Buy Bitcoin with Cash at a Coinsource Bitcoin ATM

Check out our quick video where MICA (our Mobile Interactive Coinsource Assistant) explains how to…

- How to Send Cash to Someone Using a Bitcoin ATM

Need to send cash to someone quickly, easily, and privately? A Bitcoin ATM may be…

- How Can I Spend Bitcoin?

Now that you own Bitcoin, you may wonder what you can purchase or pay for…

- Buy Bitcoin with Cash at a Coinsource Bitcoin ATM

Check out our quick video where MICA (our Mobile Interactive Coinsource Assistant) explains how to…

Can I Withdraw My Bitcoin In Nigeria

How to cash out Bitcoin to Fiat: a review of various methods and a manual. How to transfer money out the crypto exchange accounts and wallets by means of exchangers and payment systems

Cryptocurrency exchanges, cloud services, exchangers, payment systems are all engaged into a huge network, called the Cryptocurrency Universe. Applications and wallets, bank cards, accounts of the digital networks, like WebMoney or Perfect Money, all of them make up a system of depositing, exchanging and withdrawing the money. From this review, you will learn how all market participants interact, how to withdraw Bitcoin from the wallet, and if there are any alternatives to the exchanges and wallets.

How to cash out Bitcoin from the wallet

Cryptocurrencies are getting more and more popular as a trading instrument, and there are appearing more and more mediators in the crypto market. The difficulty in the interaction between all market participants is that there are no common rules and no common standard. Each crypto exchange works only with certain payment systems; each exchanger supports only a certain set of cryptocurrencies. The way of depositing and withdrawing the money can sometimes be so complex that investors lose much money due to the commission fees, to say the least. There is no standard scheme how to withdraw Bitcoin from a wallet or an exchange account, because the rules in the crypto exchanges are changing all the time: new schemes are appearing, the commissions are changing, and so on. I’m going to suggest a general manual how to withdraw Bitcoin to the bank card; you are welcome to enrich and extend it in the comments.

How to withdraw BTC to bank card and convert it into Fiat currencies

It can seem that it is more reasonable to describe the way of depositing money, rather than withdrawing it. Before you cash out your cryptocurrency to Fiat, it should be somehow deposited into your trading account. And so, it is the easiest to withdraw it in the same way as you deposited it. But, in fact, it is not that simple. First, it is far easier to deposit the money than to withdraw it. For example, you can transfer a payment of almost any appointment from your credit card, but you can’t receive it. Second, the cryptocurrency may be added to the wallet as a result of mining. That is, there hasn’t been the account depositing, in fact.

First, I’ll describe a general scheme of the relationships between all crypto market participants. There are two ways of storing your coins:

- Wallets. They are a kind of application, software that is installed on a computer. Cryptocurrency is a kind of code that will be recorded in the application (it is a very simplified outline). There are also online wallets, placed on different services, but you’d better utilize only cold ones, downloaded from the official website of the cryptocurrency developers.

- Accounts on crypto exchanges. An investor is registered and verified on an exchange and tops up the deposit, depending on the options, available on the exchange. For example, you can just transfer Fiat money from your credit card to the banking details, provided by the exchange. Or, you first transfer it to a digital wallet (WebMoney, Perfect Money etc.), and from the wallet, you transfer it to credit card or cash out via a currency exchange store.

How you can withdraw Bitcoins:

How To Cash In Bitcoin

- Transfer it from exchange to wallet;

- Transfer it from exchange or wallet to credit card via exchanger;

- Transfer it to card through the exchange;

- Transfer it from the exchange or a cold wallet to an account in digital payment systems.

How to transfer Bitcoins to Blockchain Bitcoin Wallet

Blockchain (Bitcoin Wallet) is a Bitcoin wallet, proved by time, that allows storing Bitcoins outside the exchange, on your desktop or a mobile gadget. The first step is creating the wallet:

- go to the official website of the wallet, blockchain.com;

- select the operating system, you are going to install application to;

- click “Create new Blockchain wallet”, enter your email address and the password.

You now have the wallet. I’ll describe how to transfer your Bitcoins to the Blockchain wallet on the Exmo example:

- Convert all the cryptocurrencies, you hold on the exchange, into Bitcoins

- In the section “Wallet”, by BTC, click “Withdraw”, fill in all the forms, entering your wallet address.

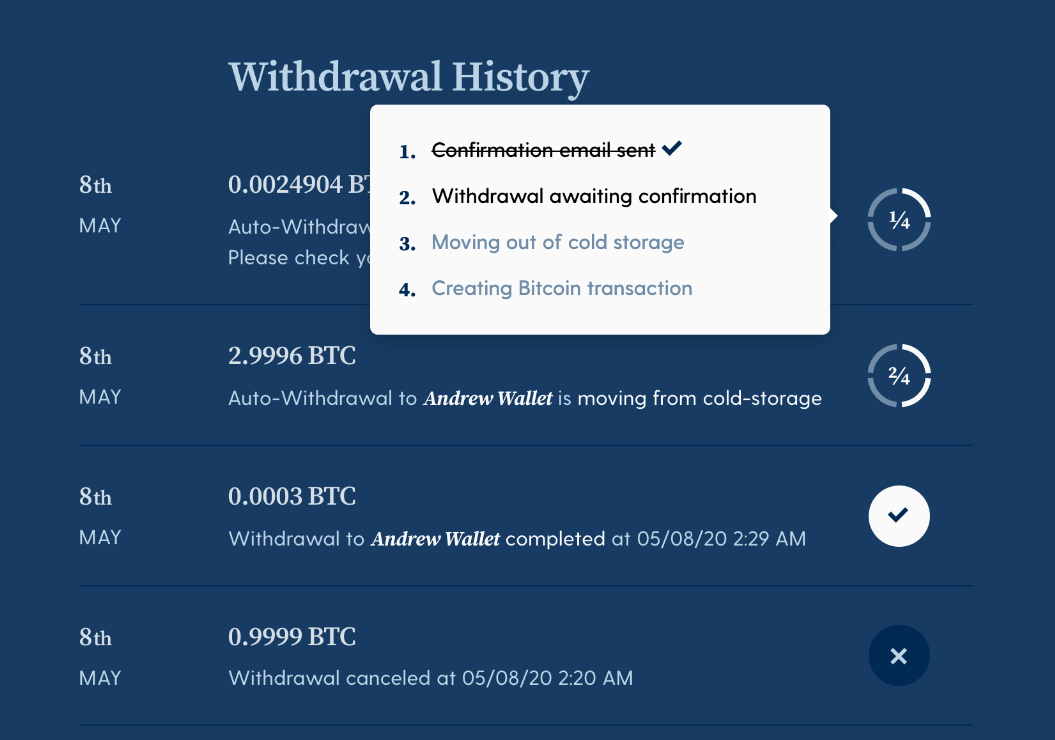

Exmo and other exchanges also provide withdrawing the money to digital wallets or directly to a cash card. For example, before you transfer Bitcoins to the bank card, you need to exchange them into U.S. dollars or the currency you need; next, you choose the withdraw method, Visa/MasterCard, and enter the card information. After the transaction has been formed, you’ll receive the confirmation email. The money will be transferred to your card in the period from a few hours to three days since the confirmation.

How to transfer Bitcoins from the Blockchain wallet (Bitcoin Wallet) to the card via exchanger

You can cash out cryptocurrency from the cold wallet with any e-currency exchanger; there are a few hundreds of them. That matter is how to avoid scammers and reduce commission costs. I suggest you use the monitoring website bestchange.com. It provides a list of reliable exchangers with the comments by real investors.

How you withdraw BTC to the card:

- On the left panel, you select a cryptocurrency to withdraw and a particular direction: Visa/MasterCard, QIWI, etc. On the left panel, there will be the list of exchangers that support the transaction.

- On the exchanger website, you check the reserve available (if you exchange BTC fro another cryptocurrency) and study the FAQ section.

- You select the exchanger, based on the following parameters: commission fees and exchange rates, official ranking of the exchanger wallet (BL - for WebMoney, TS - for Perfect Money), the mode of exchange (manual, semi-automatic, automatic), and go the website of the exchanger.

- You must register on the site. Next, you enter the account number or the card number, the money is to be transferred to.

The transaction speed is different. A fast or instant transaction is considered to be within 10-15 minutes; but it may take a few days. By the way, this monitoring provides withdrawing money through exchangers directly from EXMO, avoiding wallets.

How to transfer Bitcoin to a cash card, Visa, MasterCard, and digital wallets

The most common E-wallets are: WebMoney, Qiwi, Perfect Money. You transfer cryptocurrency to e-wallets in the same way as to cold wallets or cards. The differences are whether you need verification at the moment of withdrawing or not, the commission amount and whether an exchange (or exchanger) provides it. The same is with cash cards. On the website of an exchange or exchanger, you select the corresponding option and enter the banking information.

Conclusion. All these methods are quite easy. When you have just learnt about the schemes of the money transfers, you may be confused; but exchanges, exchangers and wallets provide a clear interface, simple, intuitive navigation and instructions for converting. And the general scheme of cryptocurrency withdrawing has been described in the article. But there are still some difficulties, you will sort out after some practice:

1. The more mediators are in the network the higher the risk is to lose your money:

Can I Withdraw My Bitcoin From Cash App

- Before you transfer the cryptocurrency from the Bitcoin wallet, find out, whether it is available in the payment system itself. For example, PayPal often blocks any transactions in cryptocurrencies. At best, the payment won’t be transferred to the card; at worst, the entire account will be blocked.

- Check the reliability of the exchangers, you work with. Scammers often pretend to be exchange services. Investors transfer the money, but they don’t get Fiat for various reasons. It can be the topic of a separate article, how to choose the right exchanger.

- Remember, that crypto exchanges’ accounts can be hacked, or there can be a network failure. And there is nobody to address; there are no courts, regulators or ombudspeople in the cryptocurrency world.

2. The more there are mediators, the more commission fees are. Wallets, exchanges and exchangers work with a certain number of partners. For example, to transfer the money to the card, you may need a chain, like “Exchange- Exchanger A - Exchanger B”. There is often a problem of not how to withdraw Bitcoins from a wallet, but how to do it with minimum risks and costs.

A far more convenient alternative is trading cryptocurrencies in Forex. Brokers usually provide over 12-15 methods to withdraw the money without any side intermediates. Even though, brokers don’t provide withdrawing real cryptocurrency to the wallet, this option is still more reliable and less costly, in terms of commission fees. I suggest you study it in more detail, reading the terms for trading major cryptocurrency pairs on LiteForex website. Crypto exchanges, wallets or Forex: what would you chose for investment?

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteForex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.