Rollover Requirement

- Rollover tells you the amount you must wager to use a bonus. Rollover amount = Bonus amount x rollover multiple (x3, x5, x10 etc). You must wager the rollover amount to withdraw winnings. Choose one of these top-bonuses, meet the rollover requirements and pay out the bonus!

- Rollover requirements (with bonus claimed) Whenever you claim a bonus (either cash or Free Play), the rollover depends on the terms of the specific offer. We urge you to read the terms and conditions to know exactly what your rollover will be.

Rollover Required Minimum Distributions Requirements. Amounts that must be distributed during a particular year under the required minimum distribution rules are not eligible for IRA rollover treatment. However, you can distribute shares of investments from your IRA to satisfy the RMD requirements. What is a bonus rollover requirement? A sports book rollover requirement refers to the amount of money you need to wager before you can withdraw your bonus and the funds you deposited. This may seem complicated, but actually, it’s quite easy. Rollover requirements, also known as wagering requirements, are found in the fine print of every casino bonus on the internet. Rollover requirements state that you must wager a certain amount of money before you can withdraw a bonus or the proceeds of a bonus.

To avoid the rollover or wagering requirements completely, you have the option to decline your bonus at the time you make a deposit. To do this, select the ‘Continuewithouta bonus‘ button from the Cashier.

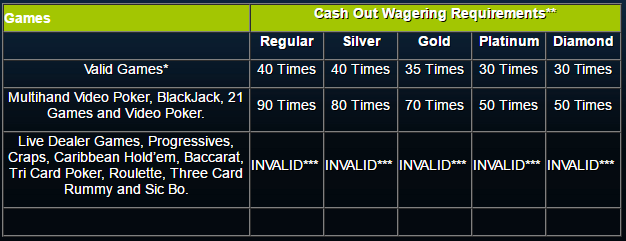

All of our bonuses come with a rolloverrequirement. You can select a bonus with a lower rollover requirement that will be easier to meet before you make a withdrawal.

Players who receive a bonus must complete their rollover requirement prior to a payout request. The rollover is the number of times a player must put into action the total deposit plus reimbursed fees and bonus. You can only complete the Rollover requirement with sportsbook action.

Please note that only the lowest amount between the risk and the win counts towards your rollover requirement.

For instance: KC Chiefs (-110) $110.00 to win $100.00. $100.00 would be applied towards the pending rollover and not $110.

To learn how to conveniently check the rollover progress bar in your account menu click here.

Find more information about the Rollover requirement on our Rollover Help Section. If you would like an in-depth explanation and examples visit our Casino Rollover article.

More articles Related to these Topics rollover, withdrawal

Waiver of 60 Day Rollover Requirement

Rollover Requirements Bovada

Under IRC section 402(c), a taxpayer can avoid being subject to federal income tax on receipt of funds distributed from a qualified retirement plan or IRA if the taxpayer rolls over such funds into another qualified retirement plan or IRA within 60 days. Generally this 60 day rollover rule is applied strictly. But this can lead to some harsh results.

In a series of Private Letter Rulings (“PLRs”) the IRS agreed to waive the 60 day rule in certain situation. While PLRs are not binding precedent, they do indicate what the IRS is likely to do in certain situations.

In PLR 201625021, the IRS waived the 60 day rollover requirement where the taxpayer’s failure to timely roll over the funds was due to an error by the financial institution. In a similar case, PLR 201625026, the IRS waived the 60 day rollover requirement where the taxpayer’s failure to timely roll over funds was due to failure of a company representative to follow the taxpayer’s instructions.

In PLR 201625023, the IRS waived 60-day rollover requirement where the taxpayer’s failure to timely roll over funds was due to her misunderstanding based on the company’s confusing financial statements.

In PLR 201625024, the IRS waived 60-day rollover requirement where the taxpayer’s failure to timely roll over funds was due to his ongoing medical condition that impaired his ability to manage his financial affairs. Likewise in PLR 201625025, the IRS waived the 60-day rollover requirement where the taxpayer’s failure to timely roll over funds was due to her hospitalization and treatments.

Rollover Requirement Calculator

Getting a waiver of the 60 day requirement requires paying a user fee and submitting a private letter ruling request to the IRS. We can assist with this process.

Rollover Requirements Sports Betting

If you have received a distribution from a qualified retirement plan or IRA and inadvertently failed to timely roll over the funds into another qualified retirement plan or IRA, please give us a call or email at 937-223-1130 or Jsenney@pselaw.com and we can discuss obtaining a possible waiver of the 60 day requirement.